This Theory is about DeFi’s endless chase for more infrastructure is like a gambler obsessively pulling the same lever, hoping this time the jackpot will drop. It is about how “incremental improvement” has become our own form of slot machine, burning cycles of capital and creativity in exchange for the faint promise of a better outcome.

Spend enough time watchingIncremental improvements have become our slot machine, burning capital and creativity for the faint hope of a better payout. the crypto space and patterns start to emerge. You learn to spot when a project is just a rehash of a familiar idea, when an investor’s enthusiasm is masking caution, and when the hype around “innovation” is really just the same story told again with new characters. This isn’t luck or insight, but the result of experience. We have seen many cycles, and right now, the old playbooks are losing their grip.

The Infrastructure Trap

For years, DeFi builders have focused on infrastructure as the primary battleground. New projects race to launch decentralized exchanges, bridges, and layers that promise higher throughput or marginal improvements in efficiency. But this race has a cost. Instead of building something truly new, many teams end up fragmenting liquidity and user attention across dozens of barely differentiated protocols. The cycle repeats because it feels safe, investors see infrastructure as a known quantity.

Yet this is an illusion.

When every new protocol is just a small tweak on the last, innovation stalls. Instead of building new ecosystems, we get an ecosystem of copies. More importantly, users do not flock to these new versions. They want experiences that resonate, not another clone to navigate.

The consequences are clear in funding patterns. Few projects move beyond early-stage rounds. Investors have learned to be skeptical of grand promises built on hype and token incentives. Protocols built on the hope that users will come simply because the product exists rarely survive beyond the hype cycle. This is not just a market correction but a signal that infrastructure alone is no longer enough.

If infrastructure isn’t enough, it’s because users were never here for the infrastructure to begin with. They come for what the infrastructure unlocks: the applications, the experiences, the moments of engagement, not the pipes and protocols themselves. And understanding why they stay leads us to the psychology of engagement.

New Generation of Builders

New builders often grasp market needs better than before, but stumble in execution. Many lack a deep understanding of token mechanics or on-chain behavior. Others adopt Silicon Valley’s “move fast and break things” ethos. Quick wins come easy, but lasting success is rare in this cutthroat landscape. Builders compete hard, users demand the best, and investors expect solid returns; everyone is competing.

There are exceptions where rapid iteration and pivoting have worked. Take pump.fun as an example. The team behind it had experience from multiple projects, including building on top of friend.tech. They were quick to fail, which can be healthy. However, pump.fun launched prematurely without anticipating its competitors’ next moves, leading to it being easily overtaken. This outcome highlights that failure was not simply due to a lack of product-market fit or moat, but also due to tactical missteps and strategic oversight.

More broadly, many meme launchpad projects face wild swings in market share because they lack durable moats, which justifies caution in valuations. Structural moats provide essential resilience, but execution and timing remain critical, both elements together determine if a project can survive and thrive.

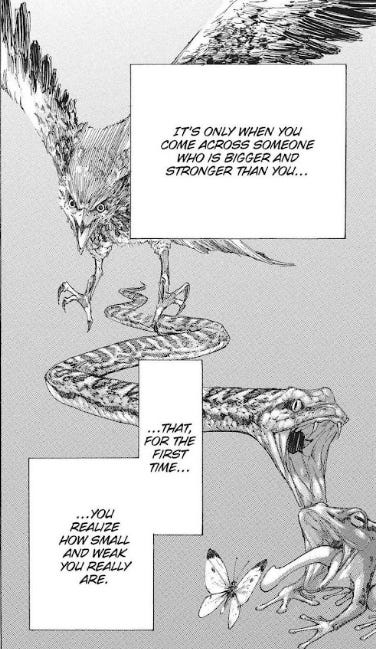

Contrast this with Blur, a standout example of a thoughtful product launch strategy. When Blur launched, the team had already spent a long alpha and beta period conducting workshops with NFT trading groups, gaining unmatched market insight. They refined their product meticulously, leaving little room for competitors to catch up.

Blur outplayed rivals by identifying their blind spots and moving faster with a product designed for professional traders. While OpenSea stuck to royalties and a casual collector experience, Blur ignored royalties initially and targeted power users with bulk listing, bidding tools, and a lightning-fast interface. Gem.xyz, once the top NFT aggregator, got stuck in limbo during its acquisition by OpenSea, slowing innovation and allowing Blur to ship a native aggregation experience faster. LooksRare, despite its community-first image, lacked a compelling product and sustainable incentives. Its $LOOKS airdrop attracted short-term farmers but failed to retain serious users. Blur, backed by Paradigm, launched a gamified points system, deep liquidity pools, and tools tailored for high-frequency traders, turning NFT trading into a competitive, rewarding ecosystem.

Newer builders often come in thinking they have the best idea but overlook how to make it resistant to being overtaken or vamped. This wastes energy and exhausts users. Competition is healthy but if it is limited to incremental feature updates rather than fundamental advantages, projects get stuck in a frustrating loop of slow, marginal improvements.

Bribing Our Way to Traction

Over the past cycle, we’ve seen real progress in closing the gap between old-school infra-first builders and a new generation that understands the value of application-layer activity. The traditional mindset, build infrastructure and wait for the apps to come, has given way to a more proactive strategy, fund the apps yourself.

Take MegaETH, for example. Their heavy investment in ensuring application-layer supply, on top of a performant base, is a refreshing shift from the norm. It’s not just about TPS or gas optimizations anymore, it’s about surfacing real usage. Other ecosystems have started to follow suit, signaling a shift in mindset. But as this trend picks up, so do the downstream problems.

In the race to bootstrap ecosystems, many infrastructure teams, whether L1s, L2s, or DePINs, inevitably find themselves playing kingmaker. If users won’t show up organically, maybe dApps will. And if dApps aren’t interested, maybe tokens, grants, or venture incentives can fill the gap. So they pour liquidity into NFT marketplaces, social apps, games, or trading tools, anything that can inflate metrics and suggest momentum.

But here’s where the whole strategy quietly unravels, the apps don’t come for the infrastructure, they come for the money. Liquidity becomes the attractor, not product-market fit. So instead of cultivating sticky, native growth, the ecosystem fills up with mercenaries. When the incentives stop, or when a better-funded chain offers sweeter deals, those apps stall or migrate. What’s left is a dashboard full of vanity metrics, dead apps, and no real conviction.

This isn’t a paradox, it’s a reflexive trap. Infra teams attempt to simulate gravity by throwing tokens around, hoping it will attract real mass. But instead of creating sustainable orbit, they get fireworks. Bright, fast, and fleeting. The activity looks impressive from afar, but it’s fueled by capital, not desire. And when the liquidity dries up, so does the movement. No one actually came for the tech.

Worse, this distorts all the signals that matter. It becomes harder to tell whether the infrastructure actually solves anything, whether its consensus design, latency, or developer tooling makes a difference. The constant flow of subsidized activity drowns out signal. Infra teams walk away with the illusion of traction, while the core product remains untested, unvalidated, and unwanted.

There’s no easy way out of this loop. Infrastructure still needs applications to prove itself. But if that activity is paid for rather than earned, it delays the hard truths that lead to product improvement. Until infrastructure becomes so compelling that people want to build on it without bribes, most ecosystems will stay stuck in this liminal space, burning capital to create motion, and wondering why none of it sticks.

Beyond Bribing Our Way to Traction

If the industry is to move beyond this cycle of “bribing our way to traction,” a fundamental shift in mindset is required. Investors must begin valuing application-layer innovation far more than infrastructure metrics alone, because real, lasting adoption depends on how users experience blockchain technology. It’s the applications that bring the promise of decentralization to life, transforming abstract protocols into meaningful, everyday tools.

At the same time, builders need to be more intentional about their choice of infrastructure. It’s not enough to chase token incentives or the flashiest specs; founders with honest vision, peak clarity, and a deep understanding of their users’ needs deserve support. Extractors who game liquidity schemes for short-term gains without delivering genuine value must be weeded out. This discipline is critical to fostering ecosystems that grow organically and sustainably, rather than inflating fragile bubbles of vanity metrics.

For broader adoption, the focus must shift away from serving only crypto natives and toward creating unique, accessible experiences for all users. Infrastructure teams should actively seek out and empower builders who aim to craft seamless, engaging applications that break beyond the echo chamber of early adopters. Only by nurturing innovation that prioritizes user experience can we move from hype to real, sticky growth.

To move from fleeting liquidity-fueled hype to lasting user engagement, we must understand the underlying psychology driving user behavior, a domain that extends well beyond blockchain mechanics. This brings us to a fascinating insight explored by Saneel in his article “Shigeta’s Dream: The Gachafication of Everything.”

The Psychology of Engagement

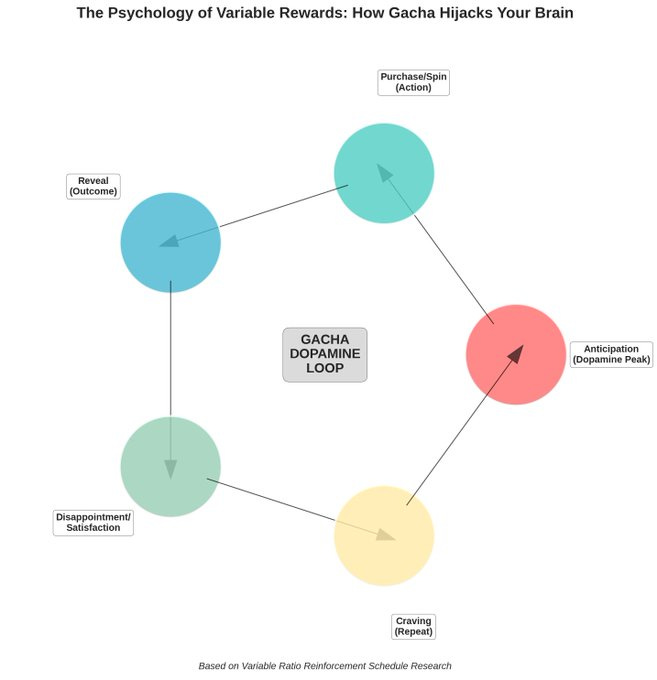

To truly grasp the forces shaping user behavior in DeFi, it helps to look beyond blockchain and code, to a fascinating psychological insight explored by Saneel in his article “Shigeta’s Dream: The Gachafication of Everything.” He traces the origins of this phenomenon back to 1960s Tokyo, when entrepreneur Ryuzo Shigeta reimagined the vending machine experience. By wrapping toys in capsules and adding an element of suspense to each purchase, Shigeta unintentionally created a powerful engagement engine based on variable rewards.

As Saneel explains, this principle taps into how our brains respond to uncertainty. Dopamine surges not only when we receive a reward but, crucially, during the anticipation of an unknown outcome. That tension, the space between possibility and reveal, is deeply addictive.

This insight has quietly reshaped entire industries. From billion-dollar mobile games like Genshin Impact that monetize gacha mechanics, to financial apps such as Robinhood’s mystery boxes, the allure of variable rewards has been harnessed to drive engagement and revenue. DeFi is no exception: the relentless scanning of token tickers, chasing the next breakout, and cycling liquidity resemble a form of jackpot simulation. Behind every breakout winner lies a graveyard of failed bets.

By drawing on Saneel’s work, we see that what might appear as random speculation is rooted in a deeply human craving for uncertainty, and that digital systems have learned to exploit this craving with remarkable efficiency. This highlights how surface layer applications should ethically leverage these psychological insights to craft consumer-level products that truly engage users beyond raw infrastructure.

The Coming Experience Layer

Armed with insights into what truly motivates and captivates users, the next wave of DeFi innovation will shift its focus from raw mechanics to rich, social, and cultural experiences; the new frontier where blockchain meets human connection.

More than just protocols and transactions, the future of DeFi is about building environments where financial activity becomes an extension of social identity and community narratives. Early signals like Friend.tech show how social capital can seamlessly translate into financial capital, hinting at richer experiences to come.

This is not to say infrastructure will disappear. The rails beneath must remain strong and reliable. But infrastructure is becoming a commodity layer, something expected but no longer the focus of user attention. The real competition will be in building experiences that feel as natural and intuitive as social media or games. Where wallets, gas fees, and tokens vanish into the background, leaving users free to engage and connect. (We are reaching this already: the average user trading memecoins doesn’t know what an ENS is or how to read smart contracts. Interface layer applications have solved this.)

A Call for Conscious Evolution

This moment requires a shift in mindset. Infrastructure projects that once powered growth will mature into the backbone of the system, necessary but no longer the engines of innovation. The new winners will be those who recognize that value lies in the experience, not just the code.

Builders and investors must stop equating technical complexity with user value. They need to embrace that users care less about how something works and more about how it feels. The future belongs to those who turn liquidity pools into playgrounds.

Builders and investors must stop chasing complexity and start crafting experiences users love. The rails exist, now build the destinations.

Once we cross that threshold, it’s no longer a game of chance. It becomes a dance with fate itself. Every risk pulses like a heartbeat, every loss a lesson carved in pain, every win a fleeting glimpse of ecstasy.

“Now then, let's lose ourselves gambling!” - Yumeko Jabami