Yuki Theory #022: The Hidden Playbook

From Runners to Metas: The Anatomy of Token Success

This is a continuation of my earlier Theory, where we looked at what it takes to sustain the viability of a main runner. This time, the focus is different. I want to dissect what makes a token succeed, because too many of the new class are deploying without understanding the game. It is no longer taboo, and it feels like free money. Yet by approaching it in such a flat, 2D way, they’re shrinking their returns over time. What starts as “free money” quickly decays into dust, until the rewards are so small they no longer move a portfolio. At that point, it is just wasted time.

This essay is both a lesson and a warning. A lesson for CT, especially the new class, on what actually makes coins succeed. A warning about the opportunity cost of playing the game wrong. By showing you how success is built, I’ll also show how much you stand to gain by doing it properly.

Let us step back for a moment. In Mexico, there are fish that colonized freshwater caves along Sierra del Abra. Stranded in complete darkness, they adapted. They shed their pigmentation, lost their sight, and eventually their eyes disappeared entirely. In the name of survival, they became hideous. I rarely think about what traders once were, but the comparison fits. If a ray of light pierced the trenches, would traders recognize it? Would they move toward its warmth? Would they become less hideous?

Traders weren’t always deployers. They once hunted new deploys by great teams on Dexspy, grinding out the craft. So why is everyone deploying instead of trading? Why have they become this grotesque version of what they once were?

The answer is simple. Opportunities dried up. Onchain stopped producing tokens with interesting, ponzi-like mechanics that forced participants to think, to strategize, to actually trade. In place of creativity, we got dead deployments, lackluster launches. Traders longed for the days of PEPE, when everyone was bidding size on runners and the entire market lifted together. Instead, with nothing compelling to trade, they created their own scraps. They saw a trend on Twitter or TikTok, rushed to deploy and bundle, only to dump it for a pitiful 2–5x on tiny size.

You can’t blame them. There is no rulebook, and survival is instinct. But survival like this only breeds noise. Returns that are already small will shrink further until they’re irrelevant. Whether you continue wasting your time with bundles or not is your choice. What matters is realizing the environment you’re worsening. Because tokens deployed like this are not worth trading. They lack sustainability, and recycling capital is not a strategy.

Deploying isn’t evil. Someone has to do it. But the way it’s done today is shallow and destructive. It helps no one. So what is the proper way? If you read my last Theory, you know that sustained viability is everything. The health of a token ecosystem is not about flashy mechanics or thin “fundamentals”. It is about liquidity flow. Derivatives serve as fuel canisters. They keep the main runner burning. Once that fuel runs out, the narrative dies.

That explains how to sustain a runner. But how do you create one?

Case Study One: GOAT

Let’s stay recent. GOAT and CARDS are two examples worth dissecting.

GOAT has its own lore when it comes to the deployment, but let’s stick to essentials. The engineer behind goatse spent serious time building, received a grant from Marc Andreessen, and Marc himself mentioned it on a podcast. The engineer was active on CT. At the same time, AI was a global trend, not just on CT but in fintech and everywhere else. These surface-level elements gave the token context and substance.

Now the deployment. Someone experienced, with years of onchain history and a wide network, deployed GOAT. He made sure word spread. He and his friends/related groups captured a significant fraction of supply. Done properly, it looked natural. Even with some wallets holding double-digit percentages, they weren’t selling. They were playing the long game. Old trading groups increased exposure safely. They trusted the deployer, the process, and the history.

Why did they trust him?

He had been a successful trader, making groups money in the past.

Previous deployments had done relatively well.

He detailed how capital inflow would be introduced through liquid funds and listing partners.

The risk-reward profile was clean: lose 4–5 figs at worst for a chance at 7 figs or more.

Opportunities like this are rare.

Within 24 hours, supply was distributed across groups and wallets. Then came the cascade. Lower-tier groups tracking older traders noticed the activity. Word spread. Prominent CT participants got pitched: not trenchers, not daily memecoin grinders, but respected voices like d_gilz, gammichan and 0xKNL__. It’s crucial to understand that these guys are not known for sniping bundles or deploying tokens etc. Instead, they occasionally dropped eloquent posts that went viral across CT, beyond the trenches. Think of the people who show up on ThreadGuy streams. They carry credibility across multiple sectors/niches.

This distinction is key. Saturation kills signal. You don’t want the usual grinders pitching GOAT. Not FlippingProfits or 0xIT4I, not your usual top performers that are crushing it on chain. You want someone with broader respect. Someone whose presence pulls in participants from outside the trenches: perps players, options traders, farmers, the ones who rarely touch memecoins. When they see someone like d_gilz mention GOAT, they assume it is liquid enough for real size. Otherwise, he’d look like a clown.

Then came external boosts. Sandra from Kaito tweeted about GOAT after 24 hours. At that moment, Kaito had enormous relevance, so her motion amplified exposure. The tweet read naturally, not forced, and came from the right person. That’s the difference between resonance and noise.

Whether her using her platform to share a token sub 100m mcap is potentially ethically not great is irrelevant to me (let people have fun?). What is interesting however is that she had crazy motion, like I cannot emphasize enough how good these kind of tweets are for tokens.

Like, if Rowdy were to tweet this exact same thing about GOAT at the time it would surely gain some bid, but NOT the bid we are seeking. We are looking for ct participants that aren’t daily trenchers.

Okay I hope you understand this.

By 48–72 hours, everyone on CT knew GOAT. Derivatives popped up and ran well. GOAT’s ceiling was tied to its market cap until it became meta leader. The inflows, narratives, and derivatives fueled growth. Read Yuki Theory #016 to grasp how they are fueling GOAT’s growth.

At this stage, smart profit-taking began. Different strategies emerged:

1. There are those that just clip out.

2. There are those that set limit orders and/or TWAP out of their position.

3. There are those that make OTC deals with liquid funds, MM’s etc.

4. There are those that set up their own LP to earn from fees.

5. There are those that deal with listing partners to earn from fees made on CEXs.

Many of you probably never considered options 3-5. Hell, you never even knew these options existed, but that’s fine. It’s important to realize that 2-5 generally tend to be the best for the growth of the coin. You won’t be creating visual sell pressure (no crazy red candles, no FSH’ing, etc.). You would be “kind to the chart“, which benefits everyone involved.

I’m glad to have been able to make you aware of some of the options that exist. It took me years to realize how the game was played, hopefully I have made your journey slightly easier.

I would strongly encourage you to do research into these exit strategies as they could look difficult/impossible to execute on. There are many that would be open to help you get things done right, you could always reach out to me and I should be able to point you into the right direction. I will rarely tell you how you should do it, there are others way more qualified than me. I merely deal in information.

From here, derivatives dilute control. You can’t dictate the flow anymore. There is only so much you can control and if you’ve done everything right from the start, then you’d be in a good position to exit and just play around with the derivatives etc. or go take a vacation, cause what you have just done is created a meta. At this point you’ve already won. You’ve created a meta.

Case Study Two: CARDS

CARDS offers another angle. I haven’t researched its mechanics in depth. My focus is purely the trade anatomy.

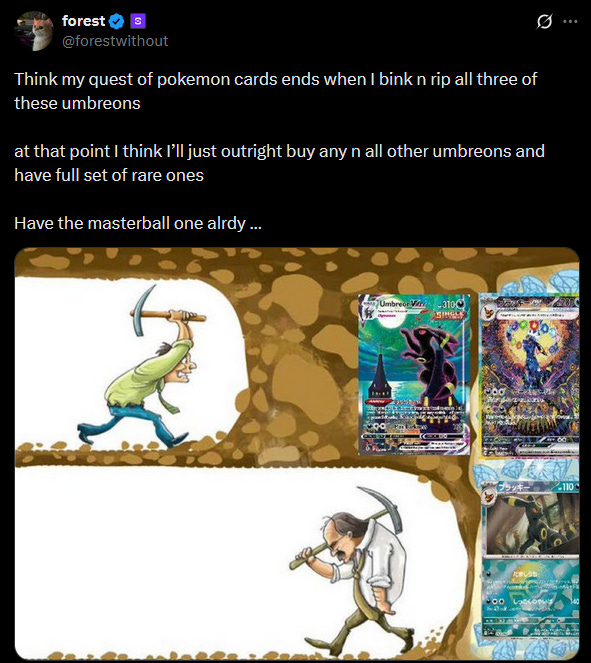

Gacha became a buzzword. Personally, I see a future for it on CT. Like GOAT, CARDS had validation outside CT. AI was hot everywhere, and gacha mirrored that. Jez and Forest talked about it constantly for a while. Gacha companies were pulling in strong revenue, and it was growing exponentially. You just need to track what the internet is obsessing over and check whether CT reflects it. There are always signs, but this is very instictual.

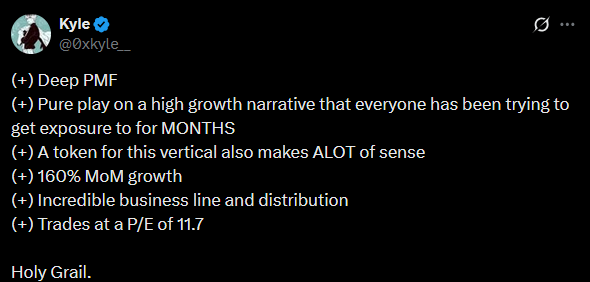

When CARDS launched, figures like Rhino and Kyle tweeted naturally about TCGs. That mattered. These guys aren’t known for low cap shills. When they drop coded messages, it feels genuine. Readers think: “If even Rhino and Kyle are talking TCGs, something’s happening.” This is credibility at work. Multiply that by ten or twenty prominent accounts tweeting daily, and the meta shapes itself.

Whodoneit was early to pitch CARDS. His role is vital for trenchers, the ones who live in low caps. But trenchers alone don’t build metas. Without participants like Kyle writing about it in Liminal, or portfolio managers like c0xswain giving it credibility, inflow from broader capital never arrives. That inflow is what transforms a runner into a meta.

The secret is that when we talk about normies, we are often not referrencing the normies you’re thinking about. We are NOT talking about your IRL friends or people that never interact with crypto. No, instead we are often actually referring to other crypto participants that don’t usually engage with low caps.

Conclusion & Final wishes

I’ve now taught you what it takes to create not just a runner, but a meta. External relevance, credible deployment, smart distribution, respected amplification, and diversified exits. That is the anatomy of success.

If you liked this Theory, share it. I don’t seek followers, but I seek an environment where people deploy and trade with intelligence instead of desperation.